What Are Stakable Coins?

Proof-of-stake coins provide an excellent opportunity to earn passive income as a crypto investor. As a result, these coins are becoming increasingly popular in the altcoin market, and their potential returns on investment are attracting more investors.

However, even with all the benefits of staking coins, how do you determine your profits? If you want to know how well your investments perform, you will need a staking rewards calculator. In this guide, you will discover a list of the best staking rewards calculators you can use in 2022.

Top Staking Rewards Calculators

Below, you will find the best staking rewards calculators for the top ten stakable coins by Staked Value. We’ll show you exactly where to go to find the information you need and how to compute how much you could make by staking each coin.

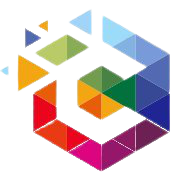

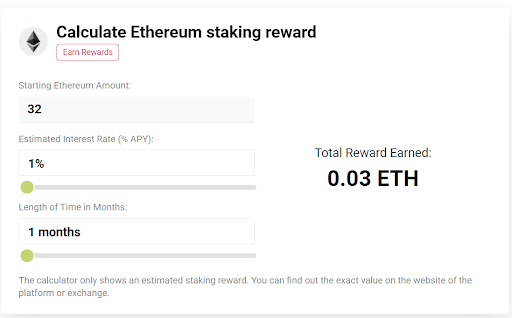

Ethereum 2.0 (ETH)

Ethereum is the 800-pound gorilla in the staking world. The ETH network recently changed from a proof of work (PoW) consensus mechanism to proof of stake (PoS), hence the name Ethereum 2.0. Staking on the platform began in December 2020, and you currently need 32 units of ETH to become a full validator. However, it’s also possible to stake via delegation if you don’t have 32 ETH. ETH offers a staking reward ratio between 5 and 21%. Annually, one can expect an average return on investment of around 7.5%.

Want to know how much you can earn staking ETH? Xceres.com offers a good staking rewards calculator you can use.

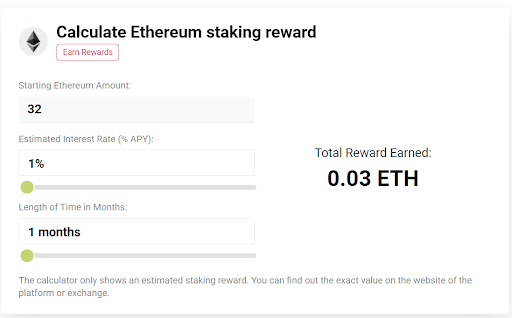

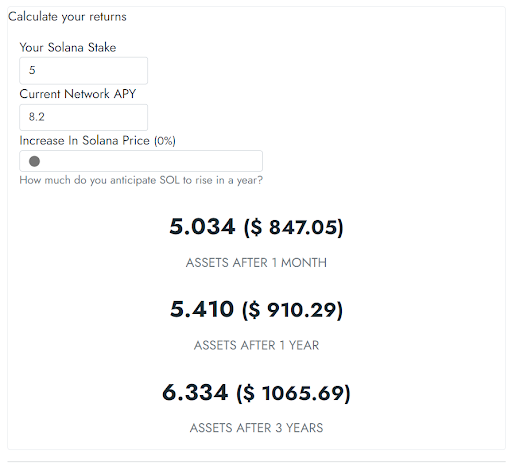

Solana (SOL)

Solana is a decentralized blockchain and one of the fastest-growing crypto ecosystems in the world. Solana boasts more than 400 projects worldwide, including DeFi, Web3, and non-fungible tokens (NFTs).

Holders of SOL—the official token of Solana—earn rewards by staking their tokens to various validators on Solana’s mainnet. Yield is based on the current inflation rate and the number of SOL staked on the network.

To calculate how much you’ll earn staking SOL, you’ll need a staking rewards calculator. A good one is Solana Compass. Enter how much you wish to stake and then set the APY, which is currently around 8%. You can also adjust the price of SOL depending on whether you think it will go up or down in the future.

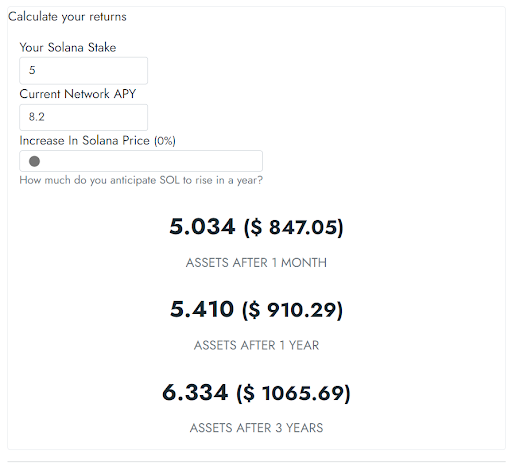

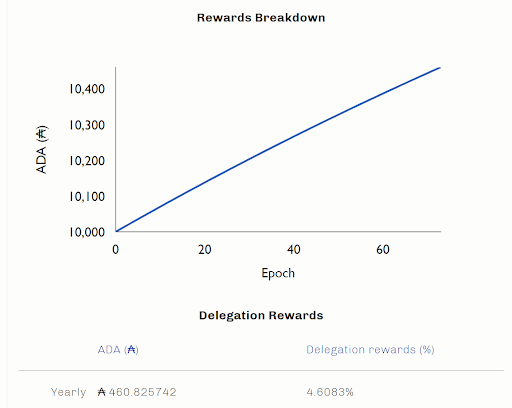

Cardano (ADA)

As a public blockchain, Cardano is open-source and decentralized. Consensus is attained through the staking process, and transactions are facilitated through its native token ADA.

Staking ADA can be done in two ways: you can delegate their stake to a pool run by another person, or you can run a stake pool yourself. These pools are either public or private, meaning they’re open to anyone or a select few. The more money added to a stake pool, the higher the chances of producing a block and earning rewards.

Cardano offers its own staking rewards calculator so you can better understand your ADA investment.

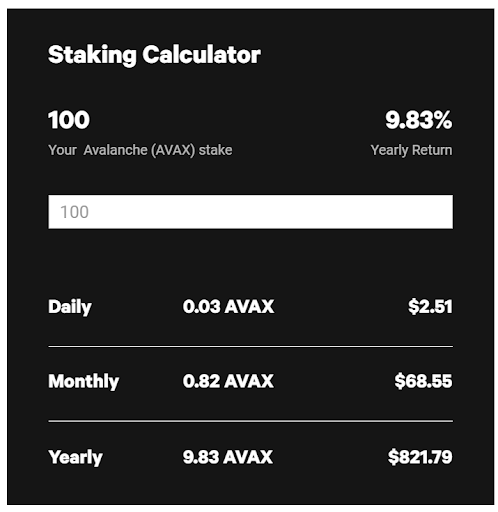

Avalanche (AVAX)

Avalanche is an open, programmable blockchain boasting smart contract capabilities. This makes it popular among developers looking to build decentralized apps. The network is also known for its speed, often requiring only two seconds or less to finalize transactions.

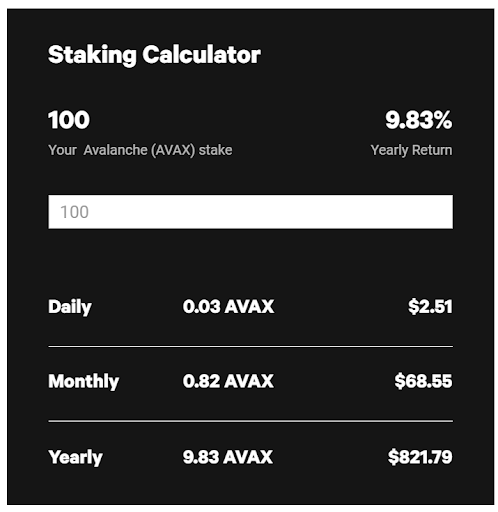

Staking on Avalanche puts users in complete control of their funds. They can also cast votes in governance proposals. Use the network’s official staking rewards calculator to determine how your AVAX investments are doing.

Terra (LUNA)

As a blockchain that works with smart contracts, Terra permits the creation of additional stablecoins. These assets can then be traded for LUNA, the official token of the network. Terra has also attracted developers looking to establish blockchain-based apps.

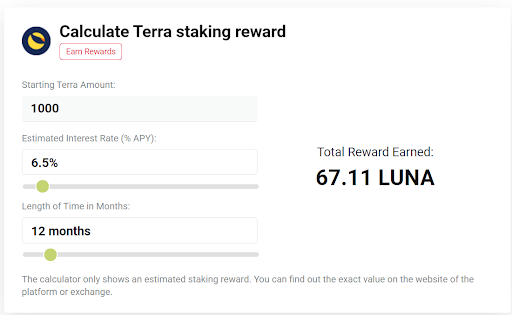

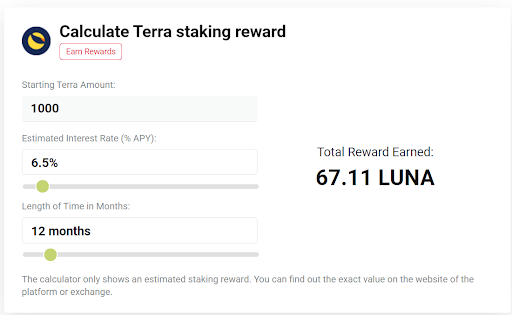

Stakers can help protect the integrity of TERRA by locking value through your LUNA holdings. Doing so grants you yield rewards. See how much you can earn by taking LUNA by checking out the rewards calculator from Xceres.com.

Polkadot (DOT)

Polkadot is a unique network that allows other blockchains to communicate with each other. The chains can transfer messages and share specific features while pooling security and value. Founded by Dr. Gavin Wood, the co-founder of Ethereum, Polkadot has become a top competitor in the staking circle.

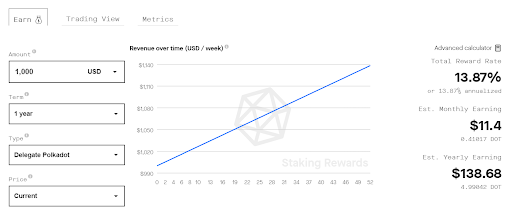

You can earn as much as 14% annually staking DOT, and stakers are nominated through a unique process.

- First, you need to create a Polkadot account.

- Then you visit the Polkadot main page and click Network > Staking menu item.

- Click “account actions” followed by the “+” nominator button.

- Choose your stash and controller accounts, then select your validators.

- Once this is done, click “bond and nominate.”

- Then enter your account password and click “submit.”

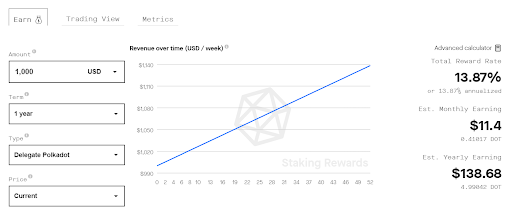

Stakingrewards.com offers a great rewards calculator you can use to see how your DOT investments are stacking up.

Binance Smart Chain (BNB)

Binance may have started as a crypto exchange, but it has become much more than that. Between offering its own token and now a staking program, Binance has become one of the world’s largest and most powerful crypto networks.

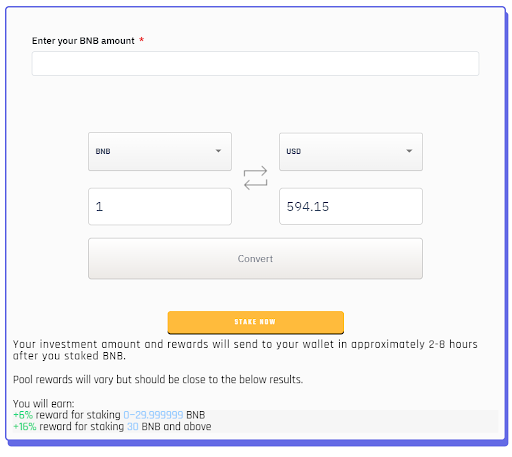

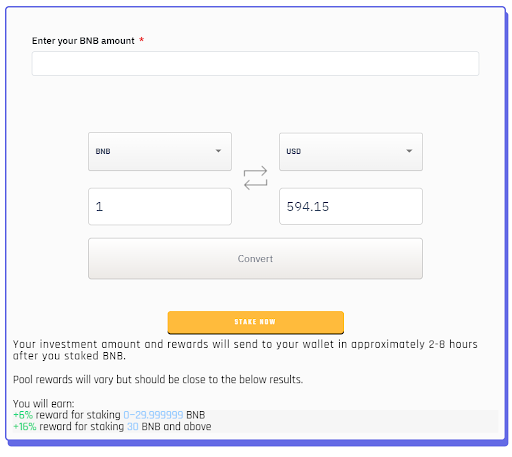

BNB provides the option to delegate Binance Coin to validators without any lower or upper limit. The unstaking period is only seven days, and annual rewards can be as high as 30%. The minimum a delegator can stake is 1 BNB, and only the top 21 validators can sign blocks and process transactions. This makes the network more secure.

Tigerstake.net offers an easy-to-use staking rewards calculator for BNB.

Algorand (ALGO)

Algorand was designed to create a borderless and global economy. It has also set out to solve the Blockchain Trilemma and is the only network to provide equal decentralization, scalability, and security. It also charges minimal transaction fees, making it popular with developers looking to establish new payment platforms.

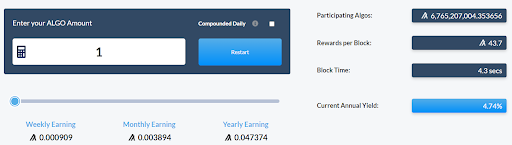

Staking on Algorand is a bit different in that the network employs a unique consensus algorithm. Rather than a proof of stake module, Algorand uses a “pure” proof of stake module called PPoS, which sees nodes stretching to all points of the globe. This prevents malicious actors from finding a central point to attack the network.

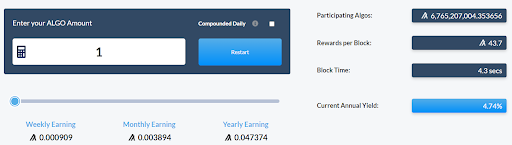

Staking rewards through Algorand can range anywhere between 5 and 10%. To find out how much you can earn, use the AlgoExplorer calculator provided by the platform.

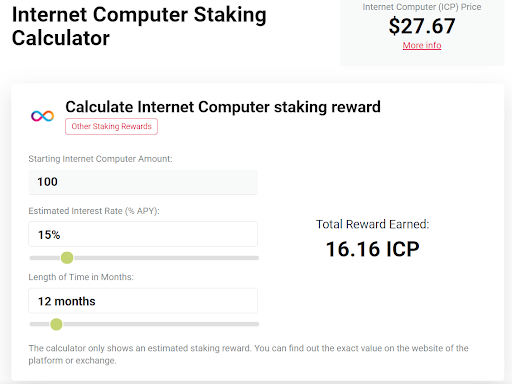

Internet Computer (ICP)

The Internet Computer is a decentralized and scalable network of computers powered by smart contracts. The system runs at web speed, and all applications are built on top of the blockchain.

To stake on the network, the first thing you’ll need to do is purchase ICP, Internet Computer’s native token. You’ll then have to create an account and authenticate it through a fingerprint ID or facial scan. You can then transfer your ICP to a supported wallet and select your unique staking options. You’re then ready to start earning rewards.

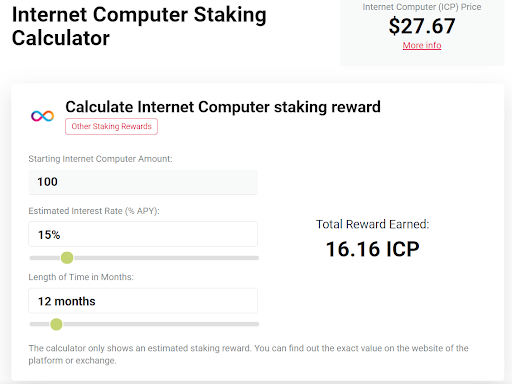

Xceres.com offers a simple rewards calculator so you can see how your ICP investments are doing.

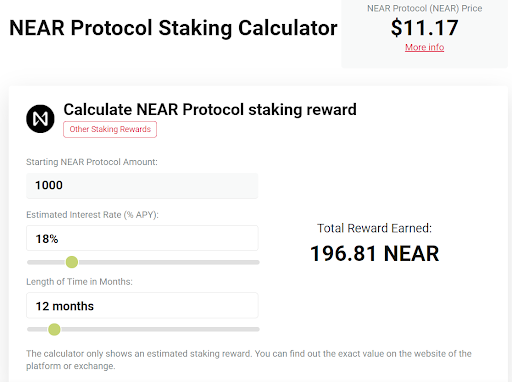

NEAR Protocol (NEAR)

The NEAR Protocol seeks to remove all barricades to Web3 adoption. The network employs quick speeds and low fees, and it’s carbon-neutral, making it an environmentally safe choice for developers. As a smart contract platform, NEAR can support multiple decentralized apps.

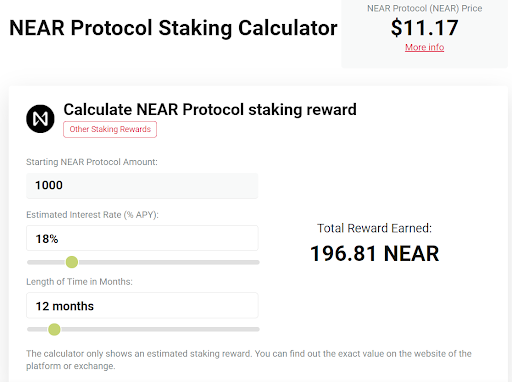

Staking on NEAR became available in late 2020. The rewards you can earn depend significantly on the number of staked tokens. As it stands, staking pools on NEAR hold roughly 200 million tokens. Xceres.com provides a rewards calculator designed to help you keep an eye on how well your NEAR tokens are doing.

Staking is a growing financial trend that allows you to earn passive income from your crypto investments. Rather than just letting them sit in a wallet somewhere and hoping they grow, you can take control of your money by placing it in a pool and earning interest throughout a set period.

Staking also helps the networks you love by keeping them safe and secure. Transactions are fully validated, eliminating the potential for fraud, and transactions are confirmed quickly. Staking can be a powerful way to ensure your crypto portfolio remains strong and active.

Related Articles:

If you want to learn more about staking and crypto investing, subscribe to our Bitcoin Market Journal newsletter today.